Yesterday, longtime pollster Stuart Elway revealed that his latest survey of Washington voters finds that Tim Eyman’s hostage-taking I-1366 is on the rocks, with support dropping to 42% and opposition rising to 42%, a significant shift from last July, when Elway found support for I-1366 to be at 49% and opposition at 36%.

Apparently unnerved by this news and the bad press it generated, Tim Eyman has gotten busy trying to change the subject. To his followers, he sent off a morning missive touting an endorsement from a militant, gun enthusiast outfit called The Citizens Committee for the Right to Keep and Bear Arms.

To the state’s press corps, he sent out a copy of a spreadsheet prepared by the Department of Revenue, which lists how much money the state has collected from property taxes every year since 1980, but is not accompanied by any analysis other than his own — which is not credible and cannot be trusted or relied upon.

Eyman’s reason for circulating the data is to prop up his narrative about Washington being a high-tax state with “skyrocketing” property taxes.

But this narrative is false.

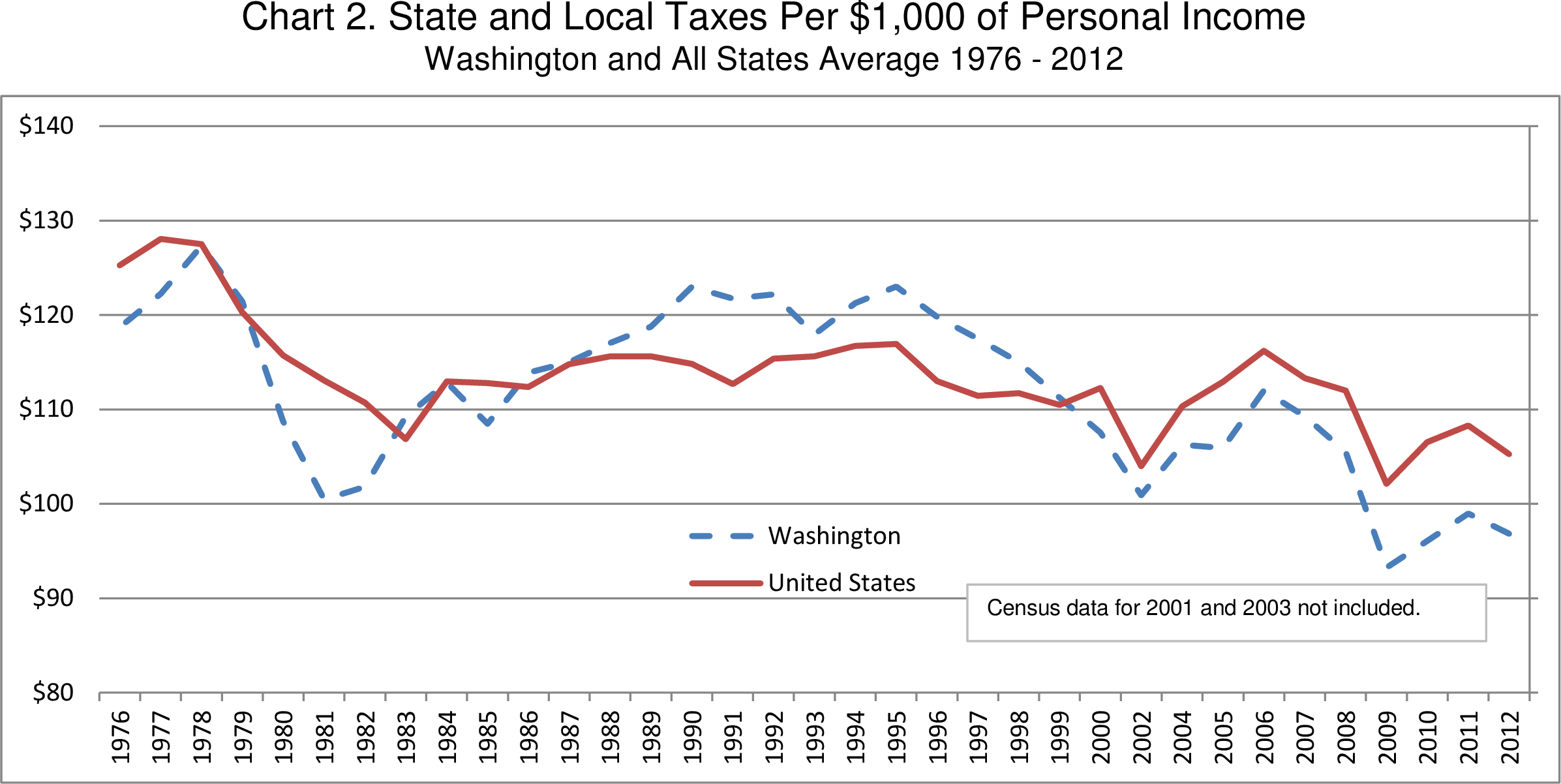

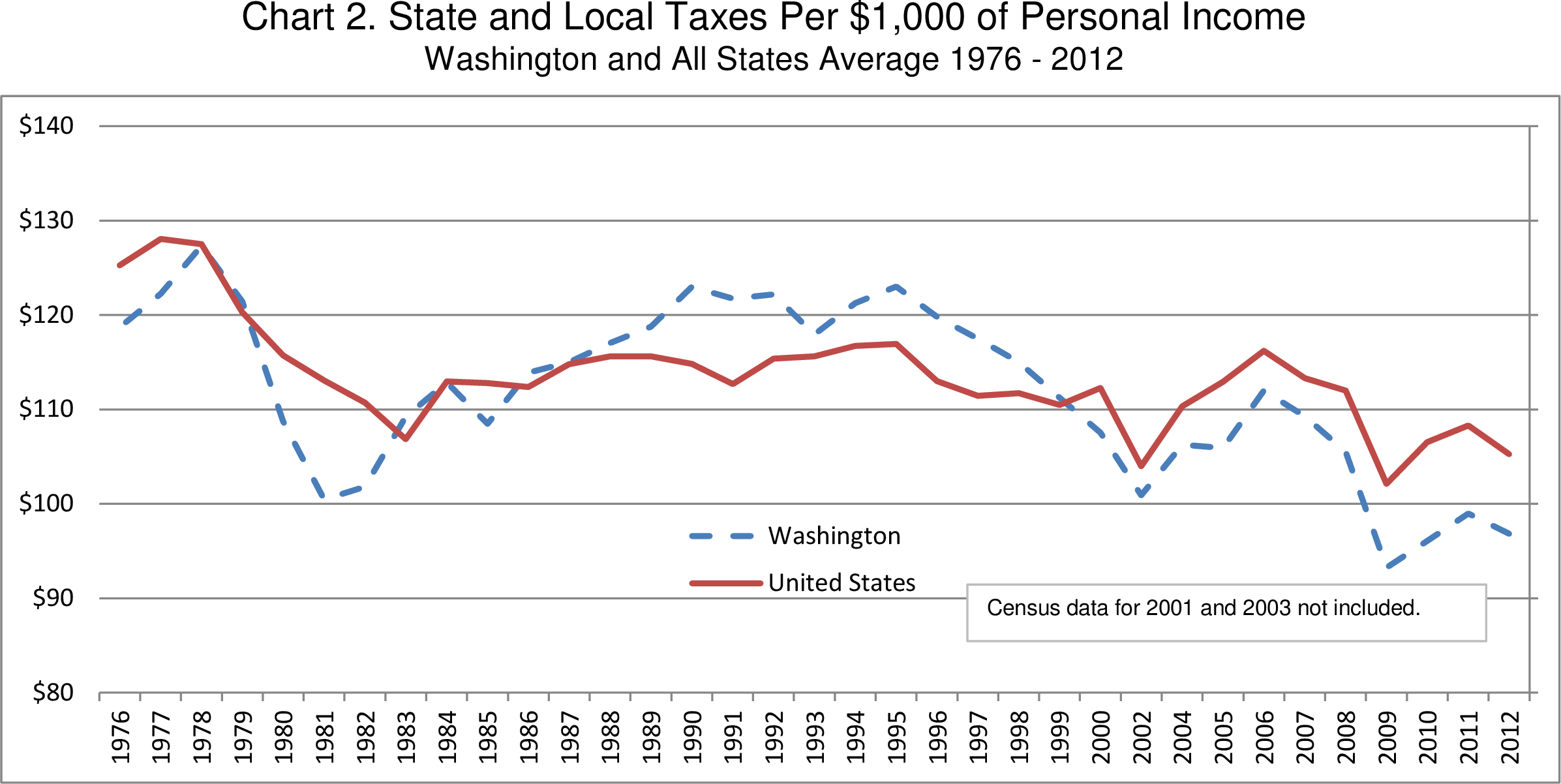

Comparative data from the Department of Revenue shows that, as a percentage of personal income, we Washingtonians are paying less in state and local taxes than we have historically, and less than residents of most other states in the Union.

In 1980, the year Eyman is misleadingly trying to draw a comparison with, DOR data shows Washingtonians were paying a little less than $120 in state and local taxes per $1,000 of personal income. As of 2012, the most recent year for which data is available, Washingtonians were paying $96.82 in state and local taxes per $1,000 of personal income. That’s also less than what residents of most other states were paying at that same time. Comparatively speaking, Washington ranks thirty-fifth among the states with respect to state and local taxes.

The United States average, as of 2012, is $105.24 in state and local taxes per $1,000 of personal income. And again, we in Washington pay less than that. We have been on a largely downward trend for decades, as this historical chart shows:

Tim Eyman doesn’t want people to know this information. That is why he never talks about it. He deals in absolutes, because absolutes produce visuals that suit his false narrative, such as the chart from DOR he sent around. But when you deal in absolutes, you cannot make useful or truthful comparisons. It is important to utilize data that allows for relative comparisons, such as the metric of state and local taxes per $1,000 of personal income. And going by that incredibly important metric, we can see that state and local taxes have been going down… not up.

1980 was a very different time: our state had a smaller population and a smaller economy than it does today. Property values and income levels were different. Washington has seen tremendous economic growth as well as an increase in population over the last thirty years. Demand for essential state and local public services has increased significantly as a consequence of population growth and new development, but funding levels have not kept up.

That’s why legislators are presently under a Supreme Court order to comply with Article IX, Section 1 of our Constitution, which stipulates that it is the paramount duty of the state to amply provide for the education of Washington’s youth.

It is true that Washington’s tax code is regressive; the Institute for Taxation and Economic Policy has ranked it the worst in the nation. The sad reality is, we have an upside-down system that requires middle and lower income families to pay a much larger percentage of their income in taxes than the wealthy do.

We at NPI think this is wrong, and we want to reform our tax code to make it more progressive. Tim Eyman doesn’t. Progressive tax reform is his worst nightmare, because it could seriously limit the appeal of future anti-tax initiatives, which he profits from qualifying to the ballot on an almost yearly basis.

It is very important that taxes be fair and equitable, because taxes are our membership dues in the State of Washington, and in the cities and counties we call home. Taxes support K-12 schools, colleges, universities, police, fire, and emergency medical response, parks, pools, hospitals, roads, transit, ferries, courts, elections, foster care, jails, prisons, courts, elections, geologic hazards mapping, and a lengthy list of health and human services. By pooling our resources together, we are able to afford these things.

But unfortunately, we haven’t been investing in our essential public services to the degree we should be. Our communities have suffered as a result, and we’ve missed economic opportunities, too. We ought to be investing more than we are. Given that our tax code is so regressive, the sensible way forward is for our state is to require the wealthy (including Tim Eyman’s wealthy benefactors) to step up and pay their fair share. Sadly, Eyman’s benefactors have no interest in being patriotic taxpayers, which is why they’re underwriting Eyman’s hostage-taking I-1366.