1999: Initiative 695 | Overview and Impact

Summary: Initiative 695 is one of Tim Eyman‘s earliest and most destructive initiatives. It attempted to repeal the state’s motor vehicle excise tax (MVET) which provided billions of dollars for Washington’s transportation system, including ferries, road maintenance, and local bus service. I-695 also tried to force public votes on all future revenue increases. Despite opposition from a bipartisan coalition, I-695 easily passed. It was struck down as unconstitutional due to having multiple subjects in early 2000, a decision that was later affirmed by the Washington State Supreme Court. Following the court decision, Governor Gary Locke and the Legislature capitulated to Eyman by repealing the statewide MVET, eviscerating billions in funding for essential public services like Washington State Ferries.

On the ballot

| Ballot Title: | Shall voter approval be required for any tax increase, license tab fees be $30 per year for motor vehicles, and existing vehicle taxes be repealed? | |

| Filed on: | January 4th, 1999 | |

| Before Voters In: | November of 1999 | |

| Sponsors: |

Tim Eyman, Mark Rood | |

| Fate: | Passed, but subsequently declared unconstitutional in its entirety by the Washington State Supreme Court | |

| Election Results: | Yes: 56.16% (992,715 votes) | No: 43.84% (775,054 votes) |

| Election Turnout: | 57.77% (percentage of registered voters who voted) | |

| Petition Drive: |

|

|

| Complete Text: | Available (PDF) | |

| Ballot Summary: | This measure would establish license tab fees at $30 per year for motor vehicles regardless of year, value, make, or model, beginning January 1, 2000. Existing taxes and fees relating to motor vehicles would be repealed. The measure provides that voter approval would be required for any tax increase enacted by the state or any city, county, or special district. “Tax increase” would include new taxes, tax rate increases, tax base expansions, and tax extensions. | |

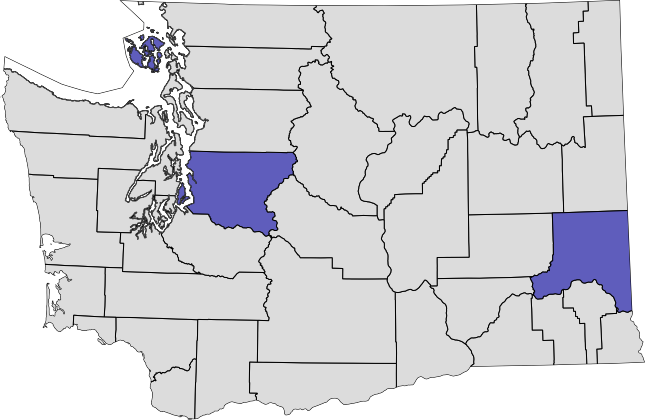

County-by-county election results

Counties that voted yes are shown in gray; counties that voted no are shown in purple.

See full breakdown (abstract in XLS)

Financing

Explanatory statement

The following is the explanatory statement prepared by the Attorney General’s office in advance of the November 1999 general election.

The Law As It Presently Exists

There is no existing law generally requiring voter approval for the imposition of an increase in fees or taxes, although voter approval is required to exceed the state expenditure limit and for certain types of local government taxes and fees.

Owners of motor vehicles pay annual state license fees and excise taxes in a combined amount when they register vehicles and obtain license tabs.

For most cars and other vehicles, the state license fee portion of this combined amount is $24.35. Most revenue from the license fees is deposited into an account that funds highway activities of the State Patrol, with smaller amounts deposited in the Puget Sound ferry operations account and administrative accounts. These provisions are found in Chapter 46.16 of the Revised Code of Washington (RCW).

The annual amount of the state motor vehicle excise tax is 2.2% of the value of the vehicle, plus a clean air tax of $2 per vehicle. Beginning in July 1999, the tax on each vehicle is reduced by a credit of $30 per year, as a result of the approval of Referendum Bill 49 in 1998. For most vehicles, the value is based on the manufacturer’s suggested retail price, gradually reduced depending on the age of the vehicle from 100% of value in the first year of service to 10% of original value for vehicles in their 13th or later years of service. These provisions are found in RCW 82.44.

The revenue from the state motor vehicle excise tax is distributed according to a formula written into the law. The transportation fund, used for public transportation and highway purposes, receives over 51% of the revenue. The motor vehicle fund, used for highway purposes, receives over 25% of the revenue. Other funds that receive percentages of the motor vehicle excise tax revenue include the Puget Sound ferry operations and Puget Sound capital construction accounts, the city police and fire protection assistance account, the municipal sales and use tax equalization account, the county sales and use tax equalization account, the county criminal justice assistance account, the municipal criminal justice assistance account, the county public health account, and the distressed county assistance account. The $2 clean air excise tax is deposited in the air pollution control account. These provisions are also found in RCW 82.44.

RCW 82.44.130 exempts any vehicle subject to state motor vehicle excise tax from all ad valorem (meaning “according to value”) property taxes. RCW 84.36.110 provides ad valorem property tax exemptions for all household goods and furnishings and personal effects in actual use by a property owner and not held for sale or commercial purposes. In addition, the same section exempts $3,000 worth of personal property, not otherwise exempt, for each property owner. However, the exemption does not apply to private motor vehicles or motor homes.

There is also a state excise tax on travel trailers and campers. The rate for this tax is 1.1% of the value of the travel trailer or camper, based on the suggested retail price of a new trailer or camper, and gradually reduced depending on the age of the vehicle from 100% of value in the first year of service to 20% of value in the 16th and later years of service. This tax is remitted to the state and distributed to cities and towns, counties, and schools. These provisions are found in RCW 82.50.

RCW 82.50.530 exempts travel trailers and campers from ad valorem property tax, except for trailers that are permanently fixed to the land.

The Effect of the Proposed Measure Should It Be Approved Into Law

The measure would require voter approval for any increases in taxes, fees, or monetary charges imposed by the state or by local government. The term “tax” for this purpose would include sales and use taxes, property taxes, business and occupation taxes, excise taxes, fuel taxes, license fees, permit fees, impact fees, and any monetary charge by government. The term “tax” would not include higher education tuition or civil and criminal fines and penalties. The term “state” would include the state itself, all state agencies and departments, any city, county, special district, and any other political subdivision or governmental instrumentality of or within the state.

If approved, this measure would repeal the existing fees and excise taxes for most motor vehicles and would impose a license tab fee for each vehicle of $30 per year, regardless of the type, age, or value of the vehicle. The new fee would include cars, sport utility vehicles, motorcycles, and motor homes. The measure would repeal specified license fees in RCW 46.16, the motor vehicle excise taxes imposed in RCW 82.44, and the excise taxes on travel trailers and campers in RCW 82.50. The measure would not repeal the schedule of license fees for heavy trucks, buses, and for hire vehicles with a declared gross weight of 4,000 pounds or more, but it would repeal the excise taxes imposed on the use of these vehicles.

The measure would also repeal RCW 82.44.130 and RCW 82.50.530, the laws which exempt motor vehicles, travel trailers, and campers from ad valorem property taxes. The measure would not amend or revise the property tax laws. Whether the repeal of these exemptions would subject motor vehicles to assessment and collection of personal property tax would depend on how the law would be interpreted.

The measure would take effect January 1, 2000.

Source: Archived Washington State Voter’s Pamphlet

Fiscal impact statement

The following is the fiscal impact statement prepared by the Office of Financial Management in advance of the November 1999 general election.

THIS PAPER HAS BEEN PREPARED by the Office of Financial Management (OFM) in response to questions concerning the financial impact of Initiative 695, which has qualified to appear on the November 1999 ballot. At the request of local governments, transit authorities and others, this update to OFM’s original April 1999 publication includes estimated impacts on local as well as state government finances. Financial impacts were also updated to reflect the state’s June 1999 revenue forecast. This information is provided for analytical purposes only and is not intended as an expression of support for or opposition to the proposed measure.

Background

A Motor Vehicle Excise Tax (MVET) of 2.2 percent is currently applied to the value of all motor vehicles. A license fee of $23.75 is also required for registration renewal. In November 1998, Washington voters passed Referendum 49, which reduced the MVET by $30 per vehicle and changed the depreciation schedule for newer vehicles. Referendum 49 reduced taxes by $258 million in the 1999-01 Biennium and redirected $143 million in MVET revenues from the State General Fund during that period to bolster transportation funding.

Initiative 695 – Overview

Initiative 695 would repeal the remaining state MVET, the state travel trailer and camper excise tax, and the state clean air excise tax in their entirety. It would also increase the annual vehicle registration fee (license tab fee) to $30 for passenger cars, cabs, motor homes, travel trailers, motorcycles, other trailers and tow trucks. Currently, the license fee is $27.75 for a first-time registration and $23.75 for the annual renewal.

In addition, the initiative would require voter approval for new or increased taxes or fees proposed by state, county, or local governments.

In the aggregate, I-695 would reduce motor vehicle taxes and fees by up to $1.1 billion in the 1999-01 Biennium and by up to $1.7 billion in the 2001-03 Biennium. On an annual basis, I-695 would reduce taxes and fees by an average of $142 per registered vehicle.

Since motor vehicle fees and taxes currently paid depend on the type of vehicle and its valuation, the amount of the reduction for each taxpayer will vary greatly. For example, an owner of a vehicle valued at $40,000 would save about $850 in taxes; whereas an owner of a vehicle valued at $5,000 would save about $80 in taxes annually

As detailed on Table 1, the initiative would eliminate up to $1.1 billion in state revenues in the 1999-01 Biennium and up to $1.7 billion in the 2001-03 Biennium, which currently support transportation, criminal justice, public health, and other programs. It also repeals the statutory method for the valuation of vehicles, as well as the distribution formulas for MVET revenue.

The initiative would take effect January 1, 2000.

MVET Distributions under Current Law

Under current law, the state MVET is expected to generate approximately $1.5 billion in revenues during the 1999-01 Biennium. Approximately 47 percent of that amount is designated for state transportation programs, 29 percent for local transit districts, and the remaining 24 percent to local governments for transportation, criminal justice and other purposes. Specific designations are as follows:

- Local transit districts.

- The municipal and county criminal justice accounts.

- County public health account.

- Distressed county assistance account.

- City and county sales tax equalization accounts.

- Ferry capital construction account.

- Ferry operations account.

- Motor vehicle fund.

- Transportation fund.

Several other revenue sources besides the MVET would also be eliminated by the initiative. One is the Clean Air Excise Tax and the Travel Trailer & Camper Excise Tax, which is expected to generate $22.6 million under current law for state pollution-control activities in the 1999-01 Biennium. Another is the Travel Trailer & Camper Excise Tax, which is expected to generate $15.9 million for distribution to cities and towns, counties, common schools, and the transportation fund.

Conversely, the provision in the initiative to raise the state’s annual vehicle registration fee would increase revenues from that source by an estimated $31.2 million in 1999-01. Revenues from the annual vehicle license fee are distributed to the Washington State Patrol, the motor vehicle fund, and the Puget Sound ferry operations account. Based on the current distribution formula for those revenues, it is assumed that those additional revenues would go into the Washington State Patrol Highway Fund if the initiative is approved.

The tables below show the financial impact of changes in these revenue sources on state and local governments if the initiative is passed into law. These tables include:

- Table 1: Current Law State Revenues Compared to I-695 in the 1999-01 Biennium

- Table 2: Current Law State Revenues Compared to I-695 by Calendar Year

- Table 3: Estimated Impact of I-695 on Revenues and Distributions by Local Jurisdiction (calendar years 2000-04)

- Table 4: Estimated Changes in Specific Local Distributions under I-695

Assessing Fiscal Impacts of the Initiative

While passage of I-695 would clearly result in a significant loss of revenue for state and local governments, estimating the total fiscal impact of the initiative presents a number of challenges. It is simply not possible, for example, to calculate the impact of Section 2 of initiative, which would require a vote of the people for any “tax increase,”* without knowing the number of additional elections or their outcome. Other issues may require legal interpretation by the courts. For the purposes of this analysis, OFM considered only those impacts that are direct and measurable. Potential fiscal impacts dependent upon legal interpretations of the initiative were not taken into account in any of the estimates contained in this report.

A complete list of assumptions used in this analysis can be found at the end of this report. Below is a list of potential issues that were NOT included in OFM’s fiscal analysis of the initiative.

- Cost of Voter Approval for Tax Increases: I-695 requires voter approval for any increase in taxes, fees, or charges imposed by the state and local governments. It is not possible to predict the cost of any additional state and local elections needed to meet this requirement or the amount of revenues that may be lost to state and local governments if voters reject these ballot measures.

- Reinstatement of Personal Property Tax: Motor Vehicle Excise Taxes are paid in lieu of property tax. In addition to repealing most of the MVET statute (RCW 82.44) and the entire statute on trailer and camper excise taxes (RCW 82.50), the initiative repeals the property tax exemptions for motor vehicles, travel trailers, and campers. This could result in making state and local property taxes applicable to motor vehicles, travel trailers, and campers. The fiscal impact of imposing the personal property tax on vehicles is unknown at this time.

- Regional Transit Authorities (RTA): Under current law, Regional Transit Authorities may levy a local option motor vehicle excise tax of up to 0.8 percent in addition to the state MVET, if approved by the voters. Initiative 695 does not directly change or repeal the RTAs’ authority to collect local option MVET. However, approval of the initiative would make the RTAs’ ability to continue collecting the tax uncertain, since it eliminates the method of determining the value of vehicles. This tax is expected to generate $102.9 million for the existing RTA in King County during the 1999-2001 Biennium and $114.5 million in the 2001-2003 Biennium.

- Local Option MVET: A municipality may levy a special MVET of up to 0.725 percent of the value of the vehicle. Under current law, the local tax is credited against the state MVET. I-695 eliminates both the state MVET and the method of determining the value of motor vehicles. The initiative would not repeal the authority of the municipality to levy the local option MVET, but there would be no state MVET revenues to take a credit against and no method in statute to determine the value of motor vehicles.

- Local Option License Fees: Under current law, a county or qualified city or town may impose a local-option vehicle license fee to support local transportation programs. It is unclear whether changes in the authorizing statute will affect local governments’ ability to collect this tax, which is expected to generate $59.5 million in the 1999-2001 Biennium.

* The initiative defines “tax” as “sales and use taxes, property taxes, business and occupation taxes, excise taxes, fuel taxes, impact fees, license fees, permit fees, and any monetary charge by government.” This provision applies to state and local governments, special districts, and political subdivisions.

Source: Archived OFM website

Voter’s pamphlet argument against I-695

The following is the text of the argument that appeared in the 2000 voter’s pamphlet urging a no vote on I-695, including the rebuttal.

I-695 IS POORLY DRAFTED AND CONTAINS LOOPHOLES

I-695 doesn’t do what it promises. It is poorly drafted and contains a major loophole that makes our automobiles subject to the property tax, just like our homes. I-695 will remove a third of state funding for transportation. Last year, voters approved Referendum 49 to make major improvements in our transportation system. I-695 reverses this decision made by the voters. Transit will be cut by 25 percent. Thousands more cars will be added to freeway congestion during commute times.

I-695 will take more than $360 million each year from local programs like Medic One and police and fire departments in communities across Washington State.

There’s more. I-695 also takes money from other valuable local programs: transportation, child abuse prevention, senior centers, crisis family counseling, school safety and mental health programs.

I-695 is unfair because it gives the biggest tax break to wealthy people who own the most expensive cars. You can bet that government won’t be taxing the rich to replace lost tax money, they’ll tax working people.

I-695 GOES TOO FAR – VOTE NO.

I-695 does nothing to control government spending. We’d all like to pay lower taxes, but I-695 means that money for essential services must come from other sources. Most states with license tab fees as low as I-695 proposes make up the difference with an income tax. Is that what the voters of Washington State want?

For more information, visit www.no-i-695.com

Rebuttal of Argument Against

I-695 cripples programs that responsible people support. There is nothing compassionate about cutbacks in fire and police protection, school safety and Medic One programs. We all want the transportation improvements approved in Referendum 49. We don’t like taxes, but we know how congested our roads will be if we reduce transit funding by 25 percent. Vote NO on I-695.

Argument Prepared By:

DON C. BRUNELL, President, Association of Washington Business; RICK S. BENDER, President, Washington State Labor Council, AFL-CIO.

Source: Archived Washington State Voter’s Pamphlet

Litigation against I-695: Amalgamated Transit Union v. State

Rulings

- Washington State Supreme Court’s decision striking down I-695 as unconstitutional (available from FindLaw)

Cost and consequences

Implementation of I-695 by the Legislature wiped out billions in funding for vital public services, with severe consequences.

In 1999-2001 biennium, the MVET was to be distributed in three main ways: 47% to state transportation, 29% to local transit agencies, and 24% to local governments.

The state Department of Revenue projected that about $1,700,000,000 in funding for public services and transportation would be lost statewide due to implementation of I-695, making Initiative 695 one of the most dangerous and sweeping right wing initiatives of all time.

In King County and the cities within King County, the measure wiped out an estimated $186,042,885 in funding for 2003-2004 alone, according to Department of Revenue estimates. Metro Transit was the biggest loser, with $124,015,975 lost during that time period.

In Spokane County and the cities within Spokane County, $29,731,406 in funding was lost during 2003-2004 according to DOR estimates. Again, transit was the biggest loser.

Spokane Transit lost $18,663,288 in potential funds for 2003-2004.

For a lengthier discussion of repercussions, see I-695’s devastating impact is no laughing matter.

Further analysis

More Information: Municipal Research & Services Center: I-695 Resource Center