2001: Initiative 747 | Overview and Impact

Summary: I-747 is a 2001 Tim Eyman initiative that stringently limited increases in property tax levies by all of Washington’s jurisdictions (to 101% of the previous year, plus new construction). By 2007, it had robbed the state’s cities of hundreds of millions of dollars in funding for public services. I-747 was co-authored by former right wing state Supreme Court Justice James Johnson and former Republican Attorney General Rob McKenna. It was struck down as unconstitutional in June of 2006, a decision that was affirmed on appeal by the Washington State Supreme Court in November 2007. However, the initiative was reinstated in a one-day special session later that month with the support of Governor Chris Gregoire, Speaker Frank Chopp, and Senate Majority Leader Lisa Brown, a move vociferously opposed by NPI’s Permanent Defense.

On the ballot

| Ballot Title: | Initiative Measure No. 747 concerns limiting property tax increases. This measure would require state and local governments to limit property tax levy increases to 1% per year, unless an increase greater than this limit is approved by the voters at an election. | |

| Filed on: | January 8th, 2001 | |

| Before Voters In: | November of 2001 | |

| Sponsors: |

Tim Eyman, Jack Fagan, Mike Fagan, and Monte Benham | |

| Fate: | Passed, but subsequently declared unconstitutional in its entirety by the Washington State Supreme Court in November 2007. Reinstated by the Legislature in a one-day special session later that month. | |

| Election Results: | Yes: 57.55% (826,258 votes) | No: 42.44% (609,266 votes) |

| Election Turnout: | 44.51% (percentage of registered voters who voted) | |

| Petition Drive: |

|

|

| Complete Text: | Available (PDF) | |

| Ballot Summary: | This measure would establish new “limit factors” for taxing districts in setting their property tax levies each year. For each local government taxing district, the limit factor would be a 1% increase over the highest of the district’s three previous annual property tax levies. For the state, the limit factor would be the lower of 1% or the rate of inflation. Taxing districts could levy higher than the limit factor with voter approval. | |

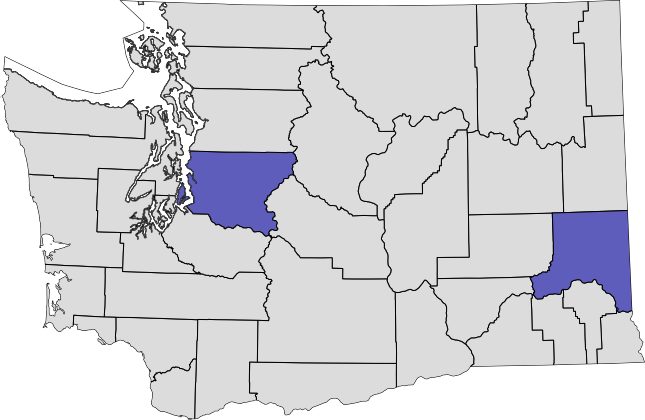

County-by-county election results

Counties that voted yes are shown in gray; counties that voted no are shown in purple.

See the full breakdown (Excel spreadsheet).

Financing

Fiscal impact statement

The following is the fiscal impact statement prepared by the Office of Financial Management in advance of the November 2001 general election.

Main Provisions

- Growth in regular property tax levies is limited.

- Local property tax districts with a population of ten thousand or fewer must limit property tax levy increases to one percent per year, unless the voters of the district approve by a simple majority vote an increase greater than this limit in an election.

- Local property tax districts with a population greater than ten thousand must limit property tax levy increases to the lesser of one percent per year or the rate of inflation. This limit may be exceeded upon approval by a simple majority of the district’s voters in an election. Local property tax districts include, among others, counties, cities, county road districts, fire districts, library districts, hospital districts, cemetery districts and emergency medical service districts.

- The state property tax levy may increase only by the lesser of one percent per year or the rate of inflation.

- If approved by voters, Initiative 747 would take effect for property taxes due in calendar year 2002.

- The limit in Initiative 747 applies to growth in the property tax base for existing property. It does not apply to growth in property tax levies due to increases in value resulting from new construction, improvements to property, and any increase in the value of state-assessed property such as utilities and railroads.

- Initiative 747 does not apply to voter approved special levies, such as local school levies.

Background

State and local regular property tax levies are limited in several ways. One limit on regular levies is on the annual rate of growth of the levy. The maximum property tax levy a regular property tax district is allowed to collect is calculated in two steps.

First, the highest property tax levy of the three most recent years in the district is multiplied by the limit factor.

Prior to Referendum 47, the limit factor was 106 percent, representing a levy growth limit of six percent.

Second, an additional dollar amount is added that is calculated by multiplying the increase in the assessed value in that district resulting from new construction, improvements to property, and any increase in the assessed value of state-assessed property by the regular property tax levy rate of that district for the preceding year. The state and local regular levies are subject to other limitations that may prevent them from reaching this maximum levy amount.

Referendum 47, approved by Washington voters in November 1997, limited the growth rate of the state property tax levy to the lesser of 106 percent or 100 percent plus the rate of inflation. It limited the growth rate of local regular levies in property taxing districts with population of ten thousand or less to 106 percent.

Local property taxing districts with populations greater that ten thousand were limited to levy growth of the lesser of 106 percent or 100 percent plus the rate of inflation by Referendum 47. Local property taxing districts with population greater than ten thousand were allowed to exceed growth of 100 percent plus the rate of inflation if, upon a finding of substantial need, the legislative authority of the property tax district approved a greater increase with a super majority vote.

Initiative 722 reduced the 106 percent limits on growth for state and local regular property tax levies to 102 percent.

I-722 was approved by the voters in November 2000 but was ruled unconstitutional by the Thurston County Superior Court in February 2001. The ruling was appealed and I-722 currently awaits a decision from the state Supreme Court.

Initiative 747 reduces property taxes by limiting the annual increase in the state and local regular property tax levies. Local property tax districts with a population of ten thousand or less must limit property tax levy increases to one percent per year, unless the voters of the district approve by a simple majority vote an increase greater than this limit in an election. Local property tax districts with a population greater than ten thousand must limit property tax levy increases to the lower of one percent per year or the rate of inflation.

This limit may be exceeded upon approval by a simple majority of the district’s voters in an election. The state property tax levy may increase only by the lesser of one percent per year or the rate of inflation.

The property tax levy limits in Initiative 747 do not apply to voter approved special property tax levies, such as local school district levies.

The state will experience revenue loss of $34,428,000 for the 2001-03 Biennium. Local governments will lose $115,246,000 over the same period. Loss to the state property tax will total $226,923,000 for the 2005-07 Biennium while losses to local taxing districts will total $571,496,000.

Illustration of Estimated Impact on Homeowners*

The limit on the growth rate for regular property tax levies in Initiative 747 will result in property tax reductions for property owners. Based on statewide average property tax rates, the owner of a $150,000 home would get a property tax reduction on state and local property taxes of approximately $23 in calendar year 2002. That property tax savings would grow to $126 in calendar year 2007.

Fiscal Impacts on State and Local Governments*

The state is estimated to lose $34,428,000 in state property tax revenue for the 2001-03 Biennium – July 1, 2001 through June 30, 2003. Local governments will lose $115,246,000 over the same period. State property tax losses will total $226,923,000 in the 2005-07 Biennium while losses to local taxing districts will total $571,496,000 in the same period. The following table shows the revenue impact by fiscal year.

State Loss Local Loss FY02 ($8,569,000) ($28,769,000) FY03 (25,859,000) (86,477,000) FY04 (46,753,000) (148,415,000) FY05 (71,270,000) (214,863,000) FY06 (97,363,000) (285,748,000) FY07 (129,560,000) (363,910,000) Estimates of local government losses in property tax revenue reflect the impact on local regular property tax districts.

Voter’s pamphlet argument against I-747

The following is the text of the argument that appeared in the 2001 voter’s pamphlet urging a no vote on I-747, including the rebuttal.

FIREFIGHTERS, NURSES, LIBRARIANS AND COMMUNITY LEADERS URGE A NO VOTE ON I-747

Initiative 747 will restrict funds we invest directly in local services like fire protection, public hospitals, libraries—even transportation.

I-747 THREATENS BASIC LOCAL SERVICES — SERVICES WE RELY ON IN OUR NEIGHBORHOODS

Because I-747 doesn’t allow critical services like fire and emergency medical districts, public hospitals, and road crews to keep pace with inflation and growth, severe cuts may be impossible to avoid. For example, Woodinville’s Fire and Life Safety District needs additional firefighters and a ladder truck to serve a growing population. Since I-747 cuts funds that come directly from residents to the fire district, critical fire protection is threatened. Facing similar shortfalls, I-747 will limit the ability of local fire departments and hospitals across the state from planning for the future, or even for emergencies—like the Nisqually earthquake or the devastating 2001 fire season.

I-747 HURTS ALL OF US: REAL EXAMPLES FROM REAL PEOPLE ACROSS WASHINGTON

“King and Snohomish County residents are sick of gridlock. I-747 means intersection and county highway improvements won’t get made,” says Snohomish County road crew worker Roger Moller. Klickitat County Fire Commissioner Miland Walling is concerned that “we will be unable to purchase safety equipment for rural firefighters.”

Pierce County library employee Patti Cox says a three- year loss of $1.5 million means “we will have to shorten library hours and cut services like children’s reading hours.”

Yakima County Prosecutor Jeff Sullivan invites “anyone to come look over the budget and suggest which felony crimes I shouldn’t prosecute.”

WE DESERVE MORE FIRE, PUBLIC SAFETY, AND LIBRARY SERVICE, NOT LESS; WE DON’T NEED I-747

I-747 will cut directly from funds that stay in our community for services we support. Our neighbors across Washington agree: our communities cannot afford I-747.

For more information, call 206.447.0888 or visit website: www.voteno747.org.

REBUTTAL OF ARGUMENT FOR

- Washington isn’t the “5th highest taxed state.” Our taxes are lower than many similar states.

- It’s inefficient to vote for services we already support: $2 million pays for an election in King County or two complete fire stations—staff and equipment—for a full year.

- Tim Eyman says he is “proud of our volunteers” without mentioning the $529,000 he paid for signatures and to his for-profit initiative business. (www.pdc.wa.gov)

Vote No on I-747.

Voters Pamphlet Argument Prepared by: KELLY FOX, Washington State Council of Fire Fighters; LOUISE KAPLAN, PhD, ARNP, Washington State Nurses Association; CAROL GILL SCHUYLER, President, Washington Library Association; JEFF SULLIVAN,Yakima County Prosecutor, (GOP); BOB DREWEL, Snohomish County Executive (Democrat)

Editorials opposing I-747

Documents and campaign materials

- Fact Sheet: I-747 and Public Libraries (Washington Library Association)

Aftermath: Effects of I-747

Fire Districts, Libraries, Pools, Parks, and Local Communities Feel the Pain

Ballot Summary:

Court & Legislative Action: The initiative was declared unconstitutional by the Supreme Court in 2007, but foolishly reinstated by the Washington State Legislature in a one-day special session in November 2007.

Effects of I-747

Initiative 695 was only the beginning of the misery. Initiative 747 soon added to the woes of local governments throughout the state. A series of painful, reverberating cuts had begun, proving that tax cuts do have real consequences. Nowhere is this more evident or apparent than in the storms that began to swirl around local governments after I-747 was enacted. Initiative 747 set a limit on the amount of new property taxes that can be levied each each year by local governments, making a 1% cap the law. Initiative 864, Eyman’s current proposal, would mandate huge across the board cuts- millions of dollars lost in a 25% slash. After Initiative 747, Seattle’s mayor at the time, Paul Schell, asked the City Council to mandate the following cuts in 2002:

- Closing the Japanese Garden at the Washington Arboretum Park and the Discovery Park visitors center on Mondays;

- Reducing lifeguards at pools and closing them on Martin Luther King Jr. Day, Presidents Day, Veterans Day and the day after Thanksgiving;

- Reducing lifeguards’ hours and eliminating a free swimming lesson program;

- Closing all but six community centers an hour early on weekdays and entirely on Sundays. Not affected are Green Lake, Rainier Beach, Rainier, Garfield, Miller and Hiawatha community centers.

Tax cuts have real consequences. This fact seems to be lost on many of Washington’s voters, especially those in Eastern Washington, who have approved four Eyman tax-slashing initiatives at the ballot. The Seattle P-I Editorial Board said of Initiative 747:

“Washington voters are being asked to join in an act of political revenge – not against foreign terrorists but against their own local elected officials…. according to the conservative, non-partisan Washington Policy Center, in 2001 local officials in 34 of the state’s 39 counties and in 17 major cities kept property tax levy increases to the 2.61 inflation rate or less…..”

“…with the state facing its own potential $1 billion budget shortfall, it will likely be unable to continue buffering many of these same communities from the impacts of I-695.”

-Seattle P-I, “I-747 hurts rural areas the most” October 24th, 2001

Libraries across Washington State depend on property taxes for 95% of their revenue. 70% of Washingtonians use libraries, according to the Washington Library Association. The public, in addition to books, now demands and requires technology services- often, to be provided for free. The three main expense areas, according to Washington Library Association, are staffing, library materials, and information technology. There is no “fat” to cut here. The cuts are direct- and they’re painful. Staff get laid off, less materials are available, and free internet disappears. Read more about Initiative 747 and libraries.

Projected Losses, I-747. According to the state Department of Revenue: “The state will experience revenue loss of $34,428,000 for the 2001-2003 biennium. Local governments will lose $115,246,000 over the same period. Loss to the state property tax will total $226,923,000 for the 2005-2007 biennium while losses to local taxing districts will total $571,496,000.

The state loss from I-747 for 2004 alone is projected to be $48,753,000. Local municipalities will lose $148,415,000 in 2004 alone.