2002: Initiative 776 | Overview and Impact

Summary: I-776 was a Tim Eyman initiative that Permanent Defense fought throughout 2002 in partnership with dozens of other organizations. I-776 unsuccessfully sought to destroy Sound Transit’s Central Link light rail project by wiping out one of the agency’s two principal funding sources, local vehicle fees. Though courts ruled that Sound Transit could continue collecting its motor vehicle excise tax in order to pay off bonds it had already sold to finance Central Link, I-776 did repeal vehicle fees collected in four of Washington’s thirty nine counties (King, Snohomish, Pierce, Douglas) which eliminated vital funding for maintenance of county roads.

On the ballot

| Ballot Title: | Initiative Measure No. 776 concerns state and local government charges on motor vehicles. This measure would require license tab fees to be $30 per year for motor vehicles, including light trucks. Certain local-option vehicle excise taxes and fees used for roads and transit would be repealed. | |

| Filed on: | January 7th, 2002 | |

| Before Voters In: | November of 2002 | |

| Sponsors: |

Tim Eyman, Jack Fagan, Mike Fagan, and Monte Benham | |

| Fate: | Passed, but subsequently voided in part by the Washington State Supreme Court in December 2006 (see Litigation). | |

| Election Results: | Yes: 51.47% (901,478 votes) | No: 48.53% (849,986 votes) |

| Election Turnout: | 56.35% (percentage of registered voters who voted) | |

| Petition Drive: |

|

|

| Complete Text: | Available (PDF) | |

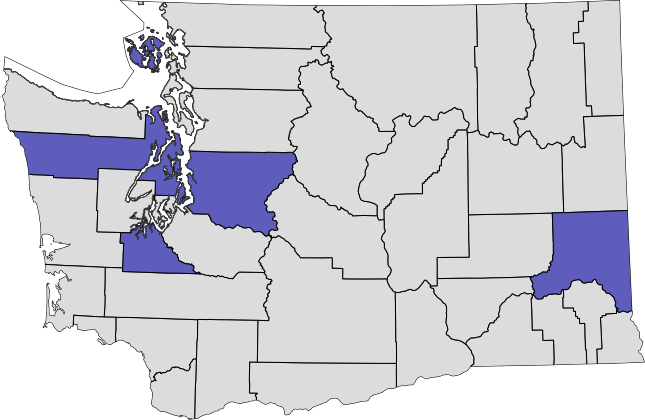

I-776 County-by-county election results

Counties that voted yes are shown in gray; counties that voted no are shown in purple.

See full breakdown (abstract in DOC)

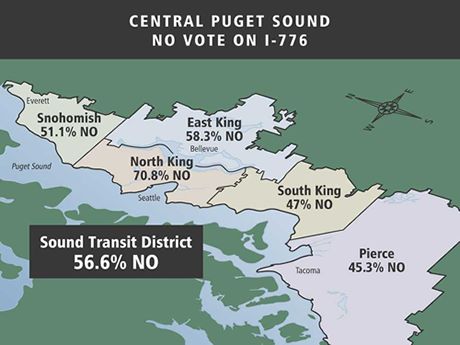

I-776 results by Sound Transit subarea

Sound Transit’s jurisdiction encompasses urban and suburban neighborhoods in King, Snohomish, and Pierce counties, as allowed by state law.

Explanatory statement

The following is the explanatory statement prepared by the Attorney General’s office in advance of the November 2002 general election.

The law as it presently exists:

In 2000, a law was enacted setting state vehicle license tab fees at $30 each year for most vehicles, including cars, sport utility vehicles, motorcycles, and motor homes. Trucks and buses are subject to licensing fees according to the gross weight of the vehicle. Under current law, these fees vary from $37 per year for trucks and buses with a gross weight of 4,000 to 6,000 pounds, to $2,883 per year for trucks and buses weighing more than 105,500 pounds. Trucks over 42,000 pounds that carry trailers and are not used exclusively for hauling logs pay higher fees, with a maximum of $2,973 for vehicles weighing more than 105,500 pounds.

Another law, RCW 81.104.160, permits cities that operate transit systems, county transportation authorities, metropolitan municipal corporations, public transportation benefit areas, and regional transit authorities to submit to their voters a proposition to collect an excise tax on the value of motor vehicles. If the voters in the affected area approve the proposition, this tax may be imposed at the rate approved by the voters, but not for more than .8% (80 one-hundredths of one percent) of the value of the vehicle. This tax must be used solely for the purpose of high-capacity transportation services.

Another law, RCW 82.80.020, permits counties and certain cities and towns to impose a license fee of up to $15 per vehicle registered in the county. A city or town may impose this fee only after approval by the voters. This fee must be used for transportation purposes.

Existing law authorizes collection of application fees upon the registration or renewed registration of a motor vehicle, over and above the basic license tab fee. Additional fees may apply in various circumstances, such as purchase of a specialized or personalized license plate, registering a vehicle previously registered in another state or country, changing a vehicle’s certificate of ownership, replacing over-age license plates, or renewing registration at a private subagent rather than a state office.

A law that was repealed in the 2002 legislative session, RCW 35.58.273, had authorized municipalities to impose a special motor vehicle excise tax. The legislature repealed this authorization and related laws, and these local taxes are no longer in effect.

The effect of the proposed measure, if it becomes law:

This measure would change the phrase “license tab fees shall be thirty dollars” to “license tab fees are required to be thirty dollars.” The definition of “motor vehicle” would remain unchanged.

The measure would repeal RCW 81.104.160 (voter-approved excise taxes for high-capacity transportation) and RCW 82.80.020 (local vehicle fees for transportation purposes). The measure would also repeal RCW 35.58.273 (already repealed by the legislature in the 2002 legislative session). The measure would also repeal several laws concerning the implementation or administration of the repealed taxes and fees. However, state and federal constitutional provisions may require repealed taxes or fees to continue to be collected, to the extent bonds have been issued pursuant to law pledging collection of specific taxes or fees, and to the extent that the value of those bonds would be diminished by the new law.

The measure would also reduce the license tab fees to $30 per year for all trucks and buses weighing less than 10,000 pounds.

The measure would not affect laws authorizing higher fees for personalized or special license plates, or the laws providing for application fees, subagent charges, or charges for additional services.

The measure would not affect laws authorizing higher fees for personalized or special license plates, or the laws providing for application fees, subagent charges, or charges for additional services.

Source: Archived Washington State Voter’s Pamphlet

Fiscal impact statement

The following is the fiscal impact statement prepared by the Office of Financial Management in advance of the November 2002 general election.

SUMMARY OF FISCAL IMPACT

Five-Year Fiscal Impact Through 2007

Initiative 776 reduces transportation funding generated by vehicle license fees. Over the next five years, the initiative: reduces state funding for highways, State Patrol and ferry operations by $93 million; and reduces local-option transportation funding for Douglas, King, Pierce and Snohomish counties, and cities within those counties, by $165 million. The impact on Sound Transit rail and regional bus service in Snohomish, King and Pierce counties depends on the status of Sound Transit bonds. I-776 repeals $318 million in voter-approved Sound Transit excise taxes, but the law may require continued collection of repealed taxes if needed to repay outstanding bonds.

FISCAL IMPACT ASSUMPTIONS

- Reducing the combined license fee for trucks with a declared gross weight of 8,000 pounds or less would result in a loss of state funding for highways, the State Patrol and ferry operations. These trucks currently pay combined license fees between $37 and $55, depending upon vehicle weight. Initiative 776 would reduce these fees to $30.

- Repealing the local-option vehicle license fee would result in the loss of general transportation funding in Douglas, King, Pierce, and Snohomish counties. Current law allows all counties (or qualified cities or towns with voter approval) to impose local vehicle license fees up to $15 per year. The estimates shown reflect only those local jurisdictions that have implemented the fee to date (Douglas, King, Pierce, and Snohomish counties).

- The loss of funding for Sound Transit light rail, commuter rail, and regional bus service would result from repeal of the authority to levy a voter-approved high capacity transportation Motor Vehicle Excise Tax (MVET). However, the law may require continued collection of repealed taxes if needed to repay outstanding bonds. The estimates shown reflect only the portion of MVET that was approved by Central Puget Sound voters in November 1996 (0.3 percent of vehicle value). The average MVET bill in the Central Puget Sound region is estimated to be $28 per year per vehicle, but actual savings would vary because the MVET is a tax based on vehicle value.

- The fiscal impacts shown assume a January 1, 2003, implementation date for Initiative 776.

- Combined license fee estimates are based on the June 2002 Motor Vehicle License, Permit and Fee Revenue Forecast.

- Local Option Vehicle Fee estimates are based on the June 2002 Local Option Tax Revenue Forecast.

- Sound Transit estimates are based on the Sound Transit November 2001 Transportation Revenue Forecast.

Source: Archived Washington State Voter’s Pamphlet

Voter’s pamphlet argument against I-776

The following is the text of the argument that appeared in the 2001 voter’s pamphlet urging a no vote on I-776, including the rebuttal.

I-776 ALLOWS THE STATE TO REVERSE LOCAL ELECTIONS AND VOTER DECISIONS

I-776 seeks to eliminate locally approved transportation funding with a statewide vote. In King, Pierce, Snohomish, and Douglas counties, voters and elected officials have chosen to increase their car tabs to fund critical transportation investments. I-776 allows voters statewide to overturn those decisions. It allows Seattle residents to overturn decisions made in Douglas County. It allows Spokane residents to overturn decisions made by voters in Pierce County.

Voters who pay a local tax and use the improvements should be the ones who decide.

Overturning the results of local elections is unfair and undermines democracy.

If you support local decision-making, vote no on I-776.

I-776 WILL DRAMATICALLY INCREASE THE NUMBER OF CARS ON THE ROAD

I-776 will increase the number of cars on the road by taking away existing express bus and commuter rail service. It will also cut investments in park and rides, HOV ramps, and light rail.

I-776 will eliminate $700 million in local, voter-approved funding for public transportation. These funds pay for Express buses that carry 6 million riders per year. They pay for Sounder commuter rail that carries 562,000 passengers per year. They will pay for Link light rail that is expected to carry 12.9 million riders per year. We cannot afford to force all those transit riders back into cars. It will make traffic even worse.

If you support transportation choices, vote no on I-776.

I-776 WILL REDUCE INVESTMENTS IN ROAD SAFETY AND MAINTENANCE

I-776 will eliminate $380 million in funding used to maintain and improve local roads in King, Snohomish, Pierce, and Douglas counties.

If you support safe, well-maintained roads, vote no on I-776.

I-776 IS OPPOSED BY A BROAD COALITION OF BUSINESS, LABOR, ENVIRONMENTAL, AND CIVIC GROUPS

REBUTTAL OF ARGUMENT FOR

Under existing state law car tabs cannot exceed $30 unless approved by local voters and local elected officials. These specified increases are dedicated to improving transportation choices or local road and safety projects. I-776 slashes voter-approved funding for buses, local commuter rail and light rail.

Defend the right of local voters to make their own decisions about local taxes. Fight traffic. Support safer roads. Vote No on I-776.

Argument Prepared By: DAN EVANS, (R), former Washington State Governor and U.S. Senator; BOB WATT, Vice President, Commercial Airplanes, The Boeing Company; RICK BENDER, President, Washington State Labor Council; JUDY HEDDEN, President, League of Women Voters of Washington; JEFF PARSONS, Audubon Society of Washington; JIM ELLIS, civic leader.

Source: Archived Washington State Voter’s Pamphlet

Litigation against I-776: Pierce County v. State

Rulings

- Judge Mary Yu’s decision striking down I-776 (Decided February 2003; archived from King County Superior Court)

- Washington State Supreme Court’s decision reversing Judge Yu’s decision (Decided November 2003; available from Justia)

Amicus briefs

- Brief from SIFMA | Issue: Whether Initiative No. I-776, which repealed certain taxes and fees that were pledged as security to repay municipal bonds, violates Article I, Section 23, of the Washington State Constitution as it applies to those municipal bonds.

News releases

- Sound Transit challenges I-776 to defend constituents’ right of local control (Sound Transit)

- Light rail and other transit projects to continue forward following I-776 ruling (Sound Transit)

Costs and Consequences of I-776

I-776 eliminated funding for road construction and maintenance in all three of Washington’s biggest counties. Tim Eyman’s adopted hometown of Mukilteo lost $160,000 from street maintenance funding in 2003 (due to I-776) and had to cut back on popular events such as the Lighthouse Festival.

In Lake Forest Park, King County, $120,000 for street funding was lost.

Work on each of King County’s major highways, including SR 520, Interstate 405 and Interstate 90, was also affected. An estimated $40,000,000 of the state’s two-year highway budget was lost due to Initiative 776.

Twenty five projects on the Eastside of Seattle, all totalling $9.7 million, were threatened by the I-776. Most of the revenue repealed by I-776 helped fund road construction.

A news report published in the aftermath of the Supreme Court’s decision upholding I-776 aptly summed up the impact in King County:

A state Supreme Court ruling that upheld tax-limiting Initiative 776 will have such a large impact on King County’s road-building fund that the 2004 capital budget will have to be rewritten early next year.

A staff report to the Metropolitan King County Council yesterday said the ruling has made County Executive Ron Sims’ proposed roads budget “inoperable.”

— Seattle Times, “Budget revamp needed because of I-776“, November 13th, 2003