2006: Initiative 920 | Overview

Summary: I-920 was a 2006 initiative that attempted to repeal Washington State’s estate tax, which wealthy families pay when money or property is transferred to an individual’s heirs at the time of their death. Sponsored by Dennis Falk and championed by Seattle Times publisher Frank Blethen, I-920 sought to abolish Washington’s only real tax on wealth. The measure qualified for the ballot with help from Tim Eyman and his associates at “Citizen Solutions”. By law, Washington’s estate tax funds the Education Legacy Trust, which supports the state’s public schools. Washingtonians resoundingly voted to defeat I-920 in November of 2006.

On the ballot

| Ballot Title: | Initiative Measure No. 920 concerns estate tax. This measure would repeal Washington’s state laws imposing tax, currently dedicated for the education legacy trust fund, on transfers of estates of persons dying on or after the effective date of this measure. Should this measure be enacted into law? | |

| Filed on: | January 9th, 2006 | |

| Before Voters In: | November of 2006 | |

| Sponsor: |

Dennis Falk | |

| Fate: | Failed | |

| Election Results: | Yes: 38.21% (778,047 votes) | No: 61.78% (1,258,110 votes) |

| Election Turnout: | 64.55% (percentage of registered voters who voted) | |

| Petition Drive: |

|

|

| Complete Text: | Available (PDF) | |

| Ballot Summary: | Washington law currently imposes a graduated tax on the transfer of certain Washington estates having a taxable value of more than 2 million dollars. Certain property, described in statute, is excluded from the taxable value. The revenues from this tax are deposited in the education legacy trust fund. This measure would repeal this estate tax. The repeal would apply to the taxable estates of persons dying on or after the effective date of the measure. | |

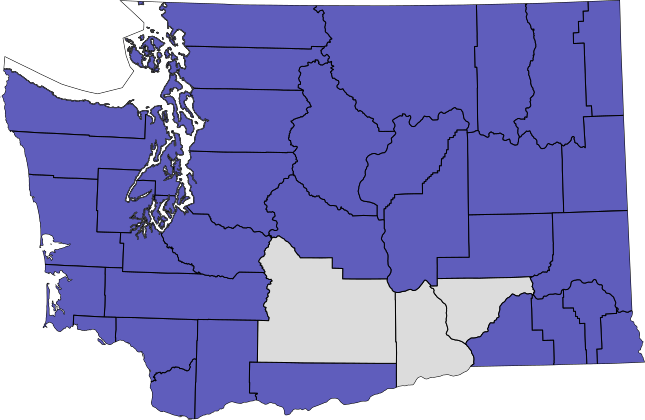

I-920 county-by-county election results

Counties that voted yes are shown in gray; counties that voted no are shown in purple.

See full breakdown (abstract in XLS) or archived elections results map.

Explanatory statement

The following is the explanatory statement prepared by the Attorney General’s office in advance of the November 2006 general election.

The law as it presently exists:

Washington law currently imposes a tax on the transfer of an estate of a deceased person if the taxable value of the estate is at least 2 million dollars. The gross value of a deceased person’s estate includes the value at the time of death of all of the deceased person’s property, real or personal, tangible or intangible, wherever it is located. The taxable estate is determined by subtracting two million dollars, and various deduction amounts allowed under state law, from the gross value of the estate. The value of certain qualified property, as described in the law, such as farmland and timberland, may be deducted from the taxable value of the estate if the property is passed to a family member of the deceased person and certain other requirements are satisfied.

Thus, such farmland and timberland generally are not subject to Washington’s estate tax.

The Washington estate tax is computed according to a table in the law. The tax rates and tax amounts specified in the table are graduated to increase with the value of the taxable estate. The minimum tax rate is ten percent for taxable estates of up to one million dollars, and the tax rate increases to a maximum of 19 percent on the portion of the taxable estate over nine million dollars.

The revenues from this estate tax, including penalties, interest, and fees, are deposited in the education legacy trust account. Money in the education legacy trust account may be used only for deposit into the student achievement fund, for expanding access to higher education, and other educational improvement efforts. The education legacy trust account is funded by the estate tax, a portion of the cigarette tax, and certain interest earnings on the account.

Washington’s estate tax is independent of any federal estate tax obligations, and is not affected by the payment of federal estate taxes.

The effect of the proposed measure, if it becomes law:

This measure would repeal Washington’s estate tax. The repeal would apply to the estates of persons dying on or after the effective date of the measure. The repeal would affect only the Washington estate tax. A deceased person’s estate would still be subject to federal laws imposing federal estate tax. Repeal of the Washington estate tax would discontinue that source of revenue for the education legacy trust account.

Source: Washington State Voter’s Pamphlet

Fiscal impact statement

The following is the fiscal impact statement prepared by the Office of Financial Management in advance of the November 2006 general election.

Summary of Fiscal Impact

Beginning July 1, 2007,Initiative 920 would eliminate $184.5 million in revenue over the next two fiscal years by repealing the state estate tax. The state estate tax is dedicated to funding public schools (kindergarten through 12th grade) and higher education. The repeal would not affect revenue for this fiscal year, which began July 1, 2006 and ends June 30, 2007.

Assumptions for Analysis of I-920

- The initiative would repeal the estate tax for taxable estates of people who die on or after the effective date of the initiative, which is 30 days after November 7, 2006.

- Estates in Washington valued at more than $2 million currently pay a graduated rate ranging from 10 percent to 19 percent on the estate assets above the $2 million threshold. The value of property used primarily for farming can be deducted from the taxable estate.

- Taxable estates are not required to pay any estate tax until nine months from the date of death of the estate owner. Because of this delay, a repeal of the estate tax would not lower state revenues until the 2007-09 budget period. The revenues for public schools and higher education in the Education Legacy Trust Account would be reduced by a projected $184.5 million in the 2007-2009 budget period.

- The estate tax is deposited into the Education Legacy Trust Account. Funds in the Education Legacy Trust Account can be used only for class size reductions, extended learning opportunities and other public school improvement efforts adopted in Initiative 728; and for expanding access to higher education through new enrollments and financial aid; and other educational improvement efforts.

Source: Archived Washington State Voter’s Pamphlet; Archived OFM website

Voter’s pamphlet argument against I-920

The following is the text of the argument that appeared in the 2006 voter’s pamphlet urging a no vote on I-920, including the rebuttal.

DON’T REPEAL FUNDS FOR PUBLIC EDUCATIONI-920 would gut a vital source of dedicated funding for education by repealing Washington’s estate tax. No one who’s not a multimillionaire pays the tax.

ONLY THE WEALTHIEST ESTATES PAY; FAMILY FARMS EXEMPTThe estate tax affects less than 1% of Washington’s families, applying only to estates worth more than $2 million for individuals and $4 million for couples. In fact, taxes are only charged on amounts above those thresholds. If a couple’s estate is worth $4,050,000, taxes are only 10% of $50,000.

Family farms are totally exempted, so farmers can freely pass their property on to their children.

A FAIR AND REASONABLE WAY TO GIVE BACK TO THE COMMUNITYAs it is, Washington’s working- and middle-class families already pay too much of the tax burden. The estate tax is a fair and reasonable way for the fortunate few to give something back. Repealing it will take $100 million away from public schools and penalize thousands of kids.

IT’S A MATTER OF PRIORITIES: MORE EDUCATION NOT MORE TAX BREAKS FOR MULTIMILLIONAIRESEstate taxes by law go into the Education Legacy Trust Fund. The Fund is instrumental in the voter-mandated effort to help reduce K-12 class sizes, giving students more individual attention from teachers. Washington’s classes are among the nation’s largest and I-920 would frustrate efforts to reduce class sizes.

The Trust Fund also supports efforts to make higher education more affordable for students from working families.

It is far more important to support public education than to allow a few wealthy heirs to avoid paying their fair share. It’s a one-time payment from the very few and it means so much to thousands of kids. Vote no on I-920.

For more information, call 206.621.1042.

REBUTTAL OF STATEMENT FOR

The few heirs affected by the estate tax are the wealthiest among us. Only estates over $2 million for individuals ($4 million for couples) pay any tax.

The most fortunate should give back something to the society that made their wealth possible.

99.5% of estates, including all family farms and most small businesses, pay no tax.

Enacting this measure would take $100 million from public education.

Vote no – no more tax breaks for multimillionaires!