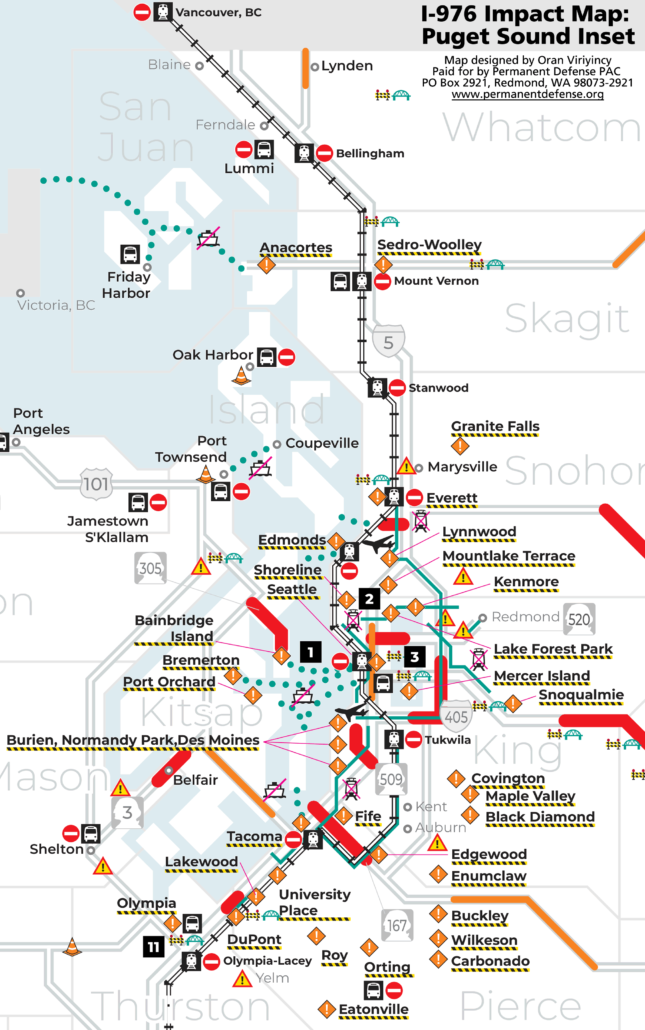

Initiative 976 Impact Map

Visualize what could happen if Tim Eyman’s incredibly destructive Initiative 976 is implemented with our I-976 Impact Map. This incredibly detailed cartographic masterpiece was designed by Oran Viriyincy in partnership with the NPI team to illustrate the threat that I-976 represents to our freedom of mobility.

Note that the map is best viewed on a large display in full screen mode. To launch full screen mode, move your pointing device over the map (or touch it if you’re using a touchscreen) and select the button that has four arrows pointing outwards.

NO on I-976 Impact MapMap basics: What’s represented here

This unique map depicts Washington’s thirty-nine counties as well as its major transportation corridors, with examples of jurisdictions and specific projects that could be hurt by I-976. Our examples are further illustrated with a series of captioned photographs that surround the map at its perimeter.

How to use the map to analyze I-976

This map is a tool intended to help Washingtonians understand what is at risk with I-976. It is not a definitive guide to what will be cut if I-976 goes through. That is because it is not possible to know or predict exactly what cuts would be made, or where, in advance of implementation. We can only make educated guesses.

This much we do know: I-976 would create a huge mess that our elected representatives would have to sort out. I-976 is a grave threat to our freedom of mobility. It threatens transportation funding at three different levels: state, regional, and local. If it is implemented, the Office of Financial Management estimates a total loss of $4.2 billion in revenue over the next six years. The amount is even higher over a ten year timeframe.

Assumptions underpinning our assessment of the risks

Time travel to the future may not be possible, but as stated, we can make some educated guesses regarding how I-976 will hurt us based on what we know about the initiative.

Here is a summary of what we know which informs our assessment of what’s at risk:

I-976 seeks to repeal vehicle fees at three different levels, and those vehicle fees fund transportation improvements

- Section 7 of I-976 repeals the retail sales and use tax on motor vehicles, estimated to to bring in $100.4 million in 2017-2019. All proceeds from this tax are deposited in the Multimodal Transportation Account. The rate is 0.3% of the selling price.

- As its names suggests, the Multimodal Account funds a long list of transportation priorities not limited to a single mode.

- Section 6 of I-976 (see subsections 1 and 2) repeals the motor vehicle weight fee and the motor home vehicle weight fee.

- The motor vehicle weight fee is split between the Freight Mobility Multimodal Account ($6 million per biennium) and the Multimodal Transportation Account (remainder).

- The motor vehicle weight fee was supposed to bring in $314.1 million in 2017-2019. The first $6 million of that is for freight mobility; then the remainder, about $308 million, is destined for the Multimodal Transportation account.

- The proceeds of the motor home vehicle fee are exclusively deposited in the Multimodal Transportation Account.

- The motor home vehicle weight fee was supposed to bring in $10.4 million in 2017-2019.

- Sections 8, 9, 10, 11, 12, and 13 of I-976 affect Sound Transit.

- If I-976 were to be fully implemented, Sound Transit’s voter-approved MVET would be eliminated.

- According to Sound Transit CEO Peter Rogoff, motor vehicle excise taxes provide around 12.3% of Sound Transit’s annual local tax revenues, which support the expansion of light rail, commuter rail, bus rapid transit, and express bus service.

- Because the MVET revenue system is pledged to bonds, the actual loss of funding could be up to $20 billion.

- Section 11 repeals RCW 82.44.035 and RCW 81.104.160.

- Section 12 attempts to force Sound Transit to retire/defease its MVET-backed bonds early. This may not be constitutional.

- Section 6, subsection 4 of I-976 repeals RCW 82.80.140.

- This is the statute that gives transportation benefit districts the authority to levy vehicle fees for local transportation improvements.

- Dozens of cities currently levy such fees. For example, Seattle has one to fund Metro bus service, while Battle Ground has one to fund road resurfacing projects.

Our Constitution prohibits using gas tax revenue, our other main source of funding for transportation investments, for anything other than highways

The Eighteenth Amendment to the Washington State Constitution stipulates that revenue raised from taxes on fuel for motor vehicles can’t be spent on anything that isn’t related to highways. Consequently, Washington cannot fund services like Amtrak Cascades (our north-south intercity train service) with gas tax revenues.

We can therefore assume with some confidence that if the vehicle fees I-976 targets are repealed, there will be a lot less money in the state’s Multimodal Account, which funds most of the WSDOT (Washington State Department of Transportation) programs that are not highway related, such as Amtrak Cascades. Legislators would either need to create a substantial new revenue source to keep money flowing to the Multimodal Account or make steep cuts to the programs funded out of that account.

You’ll notice that Amtrak Cascades is among the essential services threatened by I-976 that is represented on the Impact Map. Despite its name, Amtrak Cascades is primarily funded by the taxpayers of Washington and Oregon. It is a regional service that carries the Amtrak branding, but supported by tax dollars raised right here in Cascadia.

Over sixty cities rely on vehicle fees to fund transportation improvements

The cities that appear on the map with warning/hazard bars underneath their names are all currently using vehicle fees as a means of funding needs close to home, like street resurfacing, pothole filling, road maintenance, and in Seattle’s case, expanded Metro bus service. If I-976 is implemented, all those cities will suddenly be without that funding, leaving a long list of projects in crisis. City governments only have the revenue authority that the state gives them, so if I-976 (a statewide initiative!) goes through and eliminates cities’ authority to levy vehicle fees, many cities will have no choice but to start cutting projects because they just won’t have an alternative means of funding them.

Here’s a list of the cities, sorted alphabetically.

| City | Vehicle Fee |

|---|---|

| Bainbridge Island | $30 |

| Battle Ground | $20 |

| Black Diamond | $20 |

| Bremerton | $20 |

| Bridgeport | $20 |

| Buckley | $20 |

| Burien | $20 |

| Carbonado | $20 |

| Covington | $20 |

| Des Moines | $40 |

| DuPont | $20 |

| East Wenatchee | $20 |

| Eatonville | $20 |

| Edgewood | $20 |

| Edmonds | $20 |

| Electric City | $20 |

| City | Vehicle Fee |

|---|---|

| Elmer City | $20 |

| Enumclaw | $20 |

| Everett | $20 |

| Fife | $20 |

| George | $20 |

| Grandview | $20 |

| Granite Falls | $20 |

| Kalama | $40 |

| Kelso | $20 |

| Kenmore | $20 |

| Kittitas | $20 |

| Lake Forest Park | $40 |

| Lakewood | $20 |

| Longview | $20 |

| Lynnwood | $40 |

| City | Vehicle Fee |

|---|---|

| Mabton | $20 |

| Maple Valley | $20 |

| Mercer Island | $20 |

| Moses Lake | $20 |

| Mountlake Terrace | $20 |

| Normandy Park | $20 |

| Olympia | $40 |

| Orting | $20 |

| Port Orchard | $20 |

| Prosser | $25 |

| Richland | $20 |

| Ridgefield | $20 |

| Roy | $20 |

| Royal City | $20 |

| Seattle | $80 |

| City | Vehicle Fee |

|---|---|

| Sedro-Woolley | $20 |

| Shoreline | $40 |

| Snoqualmie | $20 |

| Soap Lake | $20 |

| Spokane | $20 |

| Tacoma | $20 |

| Toppenish | $20 |

| University Place | $35 |

| Vancouver | $40 |

| Wapato | $20 |

| Washougal | $20 |

| Wenatchee | $20 |

| Wilkeson | $20 |

| Yakima | $20 |

| Zillah | $20 |

Get a closer look at the Puget Sound region

Use the inset below to examine potential harms I-976 could inflict upon Washington State’s most populous region, including King, Pierce, and Snohomish counties.